The financial technology company Dave Inc. (DAVE) has surged in 2025, attracting attention thanks to backing from investor Mark Cuban. While the stock’s momentum is undeniable, potential investors must weigh substantial risks against its explosive growth. This analysis breaks down the fundamentals, technical indicators, and regulatory concerns surrounding Dave Inc. to determine if it’s a viable investment.

Rapid Growth Fueled by Short-Term Lending

Dave Inc. operates a banking app targeting financially vulnerable consumers. Its primary product, “ExtraCash,” offers interest-free short-term loans of up to $500, designed for those living paycheck to paycheck. This service has driven significant revenue growth, but relies heavily on a high-risk user base.

The company’s second-quarter earnings reveal impressive year-over-year gains:

- Revenue: Up 64% to $131.7 million.

- Net Income: Rose 42% to $9.1 million.

- Adjusted Net Income: Jumped 233% to $45.7 million.

- Adjusted EBITDA: Skyrocketed 236% to $50.9 million.

- GAAP EPS (Diluted): Increased 32% to $0.62.

- Adjusted EPS (Diluted): Up 210% to $3.14.

Dave Inc. has also raised its 2025 revenue and adjusted EBITDA guidance to $505–515 million and $180–190 million, respectively. These figures suggest rapid expansion, but also raise questions about sustainability.

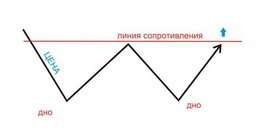

Technical Momentum and Analyst Sentiment

As of November 14, Dave Inc.’s stock has risen approximately 138% year-to-date, though it remains below its July high. Market analysts maintain a bullish outlook:

- The average 12-month price target is $300, suggesting further upside.

- All eight analysts covering the stock have a “Buy” rating.

This positive sentiment reinforces the stock’s momentum, but valuations may already reflect optimistic projections.

Key Risks and Regulatory Concerns

Dave Inc. operates in a high-risk sector, vulnerable to economic downturns and regulatory scrutiny. Key risks include:

- Execution Risk: Failure to meet growth expectations could trigger a rapid price correction.

- Valuation Risk: The stock is richly priced, leaving little margin for error.

- Regulatory Risk: The company faces ongoing legal challenges. The U.S. Department of Justice and the Federal Trade Commission allege misleading advertising practices regarding cash advances. Such legal disputes could stifle growth and erode investor confidence.

- Economic Sensitivity: Dave Inc.’s business model relies on a financially stressed consumer base. A decline in consumer spending or an increase in loan defaults could quickly turn profits into losses.

The Bottom Line

Dave Inc. presents a classic high-risk, high-reward investment. While its revenue and earnings are soaring, the stock is volatile, richly priced, and faces significant headwinds. The company’s aggressive growth is not without risk, and investors must carefully weigh the potential for outsized gains against the possibility of substantial losses.

Dave Inc. is best suited for speculative investors who can tolerate extreme volatility and understand the inherent risks associated with its business model. For more conservative investors, a cautious approach or complete avoidance may be prudent