Tim F., a retired healthcare worker from Arizona, followed conventional wisdom about claiming Social Security. He waited until age 70, believing it was the key to maximizing his monthly benefit checks. Now at 75, he has some strong words of caution for anyone considering doing the same. While waiting longer does indeed result in larger payments, Tim’s experience highlights a critical point often overlooked: what good is a big check if you don’t have time to enjoy it?

The Appeal of Delayed Gratification – and Its Pitfalls

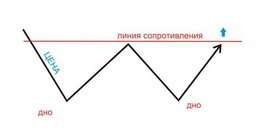

Tim believed that delaying Social Security until age 70 was the financially savvy choice. After all, waiting longer does mean receiving bigger monthly payments. He wasn’t alone in thinking this way – financial advisors often promote waiting until 70 as a strategy for maximizing lifetime benefits. This is based on the concept of a “break-even point,” where the larger monthly payouts from delaying outweigh what you would have received by claiming earlier.

For Tim, that break-even point was projected to be around age 82 – an age that now feels impossibly far away. He realized his health and priorities had shifted significantly since making that decision at a younger age. He wasn’t the energetic person he once was in his 30s or even his 40s, and unexpected changes can happen quickly with aging.

He also hadn’t factored in the emotional toll of delaying gratification for so long. “The years before 70, I was always second-guessing myself,” he admitted. The constant worry about making the right decision created stress that affected both Tim and those around him.

Life Doesn’t Always Follow a Perfect Plan

Perhaps the most poignant lesson from Tim’s story is the unpredictable nature of life. He had made plans with his wife, Sarah, assuming they would both be enjoying those larger Social Security checks together in their later years. But Sarah passed away at 68 before they could claim benefits jointly. This heartbreaking reality underlined for Tim that waiting wasn’t just about financial planning; it was also about living in the present. He wished he had seized opportunities to use extra income for travel or shared experiences with his wife while she was still alive.

Investing Missed Opportunities

Even putting aside emotional considerations, Tim regrets not exploring investment options. He acknowledges that he’s not a financial whiz, but thinks even modest investments of some of the Social Security money received earlier could have yielded better returns than simply waiting for larger checks later on.

A Different Perspective on Retirement Planning

Tim’s story isn’t about criticizing the “wait until 70” advice entirely. It’s about highlighting its limitations and encouraging a more nuanced approach to retirement planning. He offers these takeaways:

- Be Realistic About Health: Don’t assume you’ll be able to work or enjoy activities at your current level for another decade. Consider potential health changes that could impact how you spend your time and money.

- Talk It Over Together: Retirement planning is a shared decision, especially if you are married or in a committed partnership. Discuss financial goals, retirement visions, and potential contingencies together.

- Think Beyond the Check:

Don’t just focus on maximizing monthly benefits. Think about what you truly want to do with your time and money in retirement: travel? Hobbies? Spending time with family? Let those aspirations guide your financial decisions.

Tim’s experience serves as a reminder that every individual’s journey is unique. While waiting until 70 might be the right choice for some, it isn’t necessarily the best option for everyone. It’s essential to factor in personal circumstances, health considerations, relationship dynamics, and most importantly, your vision for how you want to spend those crucial retirement years.